Edward Thorp Casino

- Edward Thorp Net Worth

- Edward Thorp Casino Buffet

- Edward Thorp Casino Atlantic City

- Edward Thorp Casino Entertainment

- Edward Thorp Casino Entertainment

- Edward Thorp Northwestern

Edward Thorp is the bestselling author of Beat the Dealer.He revolutionized gambling as he proved how to beat blackjack with card-counting and invented the first wearable computer.

Inducted in 2002

Best known as the author of the Internationally renowned book, ‘Beat the Dealer‘ Edward Thorp was a mathematics professor at MIT who proved that blackjack could be won through a technique referred to as Card Counting.

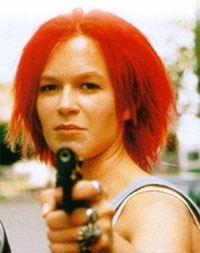

With that in mind, Edward O. Thorp is a name that will always be remembered by blackjack fans. He had an undeniable passion for the game and if you want to experience the excitement of blackjack then visit Lucky Nugget Casino. The man behind the name, 'Fortune's Formula,' is a living legend: Edward O. In 1958 Thorp was a young, up and coming professor at MIT. He went to Las Vegas on a holiday vacation and experimented with a blackjack strategy about which he recently read. Blackjack Edward Thorp, the pensive professor above, is shaking the gambling world with a system for beating a great card game. Edward Thorp is a famous mathematician, lecturer and blackjack player who is credited with inventing wearable computers which facilitated modern card counting systems which have enabled blackjack pros to win millions of dollars. He also authored the bestselling book “Beat Continue reading →.

Edward Thorp Net Worth

He completed undergraduate and graduate work at U.C.L.A., receiving the B.A. and M.A. in physics, and the Ph.D. in mathematics in 1958. He has taught at U.C.L.A., M.I.T., New Mexico State University and was Professor of Mathematics and Finance at the University of California at Irvine.

He was among the first pioneers of computer aided devices for blackjack even learning to program in FORTRAN on an IBM 704 with a special emphasis on card counting schemes and cards that were not reshuffled at the end of a deck.

To prove his theories this nutty professor headed off to Las Vegas with $10,000 in money fronted by mobster Manny Kimmel. He won $11,000 in the first weekend before being kicked out by security. Current shuffling rules at casinos are a direct result of Dr. Thorp’s success.

Edward Thorp Casino Buffet

Once proven he published his book which instantly jumped to the top of the New York Times Best Seller list. He is noted in academic circles for this process as being the first to eschew traditional academic publishing in order to go directly to a mass audience for his findings as well as risking very real physical damage to verify a computer simulation. He was also the first to use a computer as a gambling aid.

Edward Thorp Casino Atlantic City

Beat the Dealer was not an easy read for ordinary players at first, because it was difficult for average gambler to use Thorp’s theory in live casinos. Along came the second edition of the book in 1966. Julian Braun assisted Thorp in making this edition more down to earth, so that ordinary players could understand it and utilize it at casinos.

Thorp didn’t stop at casinos, he applied his knowledge and success with “Beat the Dealer” to the ultimate casino: The Stock Market. In 1967 “Beat the Market” came out. Together with co-author J.Regan, Thorp created a system, helping to read the stock market and play it similarly to a casino game.

He went on to help people invest in the stock market via his own firm “Edward O. Thorp & Associates”. Thorp made a considerable fortune in the securities market and through his own hedge fund.

Edward O. Thorp’s books

Beat the Dealer

The essentials, consolidated in simple charts, can be understood and memorized by the average player.

Beat the Market

A guide on how to play stock market in order to make fortunes.

Edward Thorp Casino Entertainment

The Mathematics of Gambling

This book gives a quick overview of making money, or losing money more slowly, at various games of chance.

The Kelly Capital Growth Investment Criterion: Theory and Practice

This volume provides the definitive treatment of fortune’s formula or the Kelly capital growth criterion as it is often called.

Edward Thorp Casino Entertainment

Prominent Vegas gambler, accomplished university professor, distinguished financial innovator and famed “father of the quants” –the path of life that Edward O. Thorp chose to lead is simply one tough act to follow. By combining a multitude of careers (and successfully at that) in one lifetime says a lot about this genius of a persona.

Born in Chicago, Thorp was raised wholly in Southern California where he finished his BA and MA degrees in Physics, plus a Mathematics doctorate degree to boot, all from the University of California in Los Angeles. Come the 1960s, he went on to pursue a teaching career and started at the MIT (Massachusetts Institute of Technology) as a Math professor. He also had teaching stints at the New Mexico State University from 1961 to 1965, and at the University of California at Irvine from 1965 to 1977. But in between all that academic teachings, Thorp was also busying himself revolutionizing the world of blackjack.

If you want to beat the odds at blackjack, one may try card counting. There are many ways to count cards, but in its most basic form, the theory is to bet on the small side when there are still a lot of low-numbered cards on the deck, then bet big when most of the low cards have all been played and there are lots of high-numbered cards still left at the deck.

Edward Thorp got the initial idea that the blackjack odds can be beaten back in 1958 when he came across a written article about a blackjack theory developed by four Army men in 1953. Thorp, being a math Ph.D. at the time was already working at the MIT and has prime access to two things—first is an IBM 704 computer, without which, he would later recount “all his mathematical analysis would have never been possible”, and second, a pool of people with similarly brilliant minds.

Thorp wrote to one of the original authors of the blackjack theory that he saw and requested to see the original Math involved. And using the IBM computer that he programmed by himself, Thorp moved on to developing the first-ever blackjack counting strategy. But the next challenge was getting someone to take a look at his invention.

In 1961, Edward Thorp presented his mathematical findings to the American Mathematical Society. People from the world of gambling have snubbed at his idea, but his claims have attracted the attention of a reporter by the name of Tom Wolfe who wrote an article about Thorp and his proposed strategy and published it at the Washington Post. Soon enough, Emmanuel Kimmel, a notorious bookie, agreed to fund Thorp with $10,000 for him to try his theory out on actual casinos but with a catch—Kimmel getting 90% of the cut.

The strategy proved to work really well, and by 1962, Edward Thorp published the bestselling book titled “Beat the Dealer” based on his personal experiences and was reprinted countless times as of today. Because of that card counting strategy, the game exploded overnight and Thorp became a threat to various casinos. There have been reports of at least one casino trying to drug Thorp, while some other card counters were allegedly being threatened or beaten. The strategy made all casino owners nervous to the point that they all colluded to change the game’s rules to bring the odds back to their favor.

It did not work though as word got out and players lost their edge. The blackjack tables were soon left empty prompting the owners to revert the rules back with a slight twist: they are now using multiple decks and cards are being dealt from a card shoe which allows dealers to do frequent reshuffling. Yet by the year 1966, Edward Thorp had reportedly won over $25,000 from all his card counting stints at the Sin city. He was quoted saying that “it was never really about the money but rather about the science and ideas; though the money was a great supplement to a mere professor’s wages.”

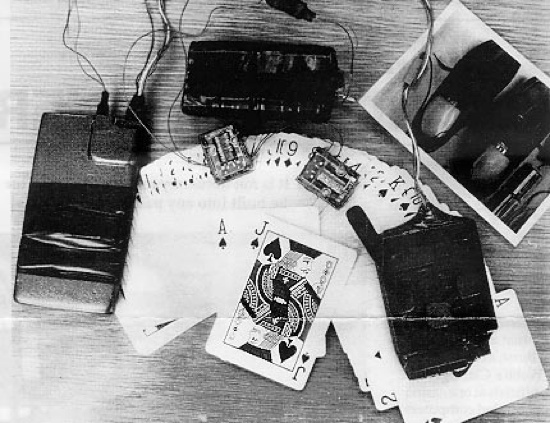

In the second edition of his book printed in 1966, it was revealed that his research was aided by the use of the first wearable computer which he co-invented and developed by an MIT colleague in the name of Claude Shannon. It is with Shannon that Edward Thorp will again visit the question that he pondered on years before: whether he could apply the same principles of mathematics to beat the odds of roulette as he did with blackjack.

That wearable device is decidedly rudimentary by today’s definition of a single computer—one that is conceptualized to perform a single task—beat the roulette. It looks nothing more than a box that’s been filled with wires that are strapped around the wearer’s waist. The device can then be triggered by the tapping of a foot and will send an audible sound to the user via an earpiece.

During their tests, it was determined that the wearable computer stands to give the user a 44% edge in the game of roulette which is way more than enough to make it worth all their experimentation efforts. By the summer of 1961, Thorp and Shannon decided that it was time to hit the casinos to test out their invention. So in August that same year, they spent a week in Vegas with Thorp’s wife Vivian and Shannon’s wife, Betty, in tow.

Wearing a computer back in those years proved to be a challenge, mainly because the goal is for the computer “not to be seen” –a kind of hard thing to do. So while problems of keeping the computer inconspicuous hampered them from making any “serious bets”, both Thorp and Shannon deemed that their project was a success. The original device was now residing comfortably at the MIT Museum at Cambridge, MA. The exact details of the technology though were never revealed until Thorp published his manuscript: The Invention of the First Wearable Computer back in 1998.

Thorp recounted on an interview that he and Shannon considered developing a simple blackjack wearable computer but then later on decided against it since mental card counting is much easier. In 1985, a Nevada law was passed banning the use or possession of any device that can predict the outcome or can analyze the results of the games being played. For Thorp, another sense of pride, as people as well as legislation deemed the descendants of the first wearable computers formidable enough to be outlawed.

Edward Thorp has long since been inducted to the Blackjack Hall of Fame for all his contributions at making the game more mainstream. His card counting techniques are still being used by thousands of professional blackjack players today. And being the bright mind that he is, in the late 1960s, he transitioned his skills from casino gambling to Wall Street. Putting his vast knowledge in probabilities and statistics, Thorp was able to discern and exploit a lot of anomalies in the pricing of the securities market. He published yet another hit in 1967 entitled “Beat the Market: A Scientific Stock Market System” which further sealed his mark in the business arena. With all his accomplishments, Edward Thorp is one big example of how a person can use one’s intelligence and smarts not to only help himself but to help millions of others.